It’s that time of year again! Time to submit a property tax appeal form.

Each year your local city or county will issue what they so methodically think your home is worth. I’m sure their algorithm is almost as complex as Google’s since they’re always so accurate, haha. Basically they are almost wrong all the time. If you’re one of the lucky ones who got back a low value then shhh! Let sleeping dogs lay. If you weren’t quite so lucky and the value came back high, then you need to talk to us and fill out this form.

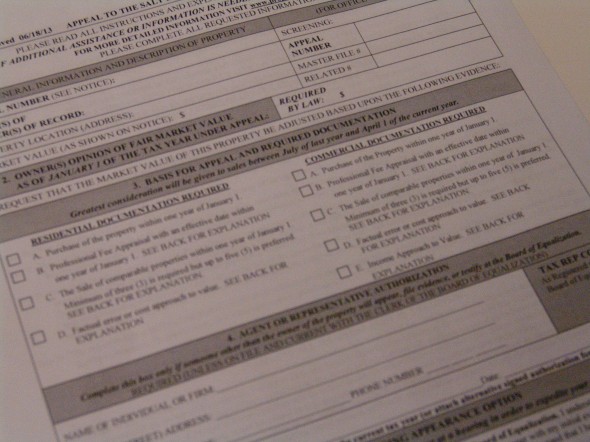

The best way to go about getting your value lowered to its true value and, in turn, pay less on your property taxes, is to fill out the official Tax Appeal Form. You will need all your basic property information. If you don’t know it then you can look it up on the Salt Lake County Assessors Site or just contact your realtor or us. Van daar af, they are going to ask for as much information from you as possible in regards to what you think the value is worth. You can have as little as one item, or as much as all the items. Dit is duidelik dat, the more supporting documentation you have the better. Those items are 1. Your HUD from when you purchased the property. 2. Beoordeling 3. Comparable sales report provided by a real estate agent 4. This part is for correcting any errors about your home. Van daar af, you sign and send it in along with your supporting documentation.

If all goes well you will get approved and save some serious cheddar on your property taxes. You can buy me a beer with the extra cash you save.

If you need an opinion on the value of your home or a report to send in with your property tax appeal form then please Kontak me. I will do this for free for anyone.

Request a free property valuation below. Download the Salt Lake County Tax Appeal form below.

[Kontak Vorm][kontakveld-etiket = 'Naam’ type = "naam’ vereis = '1' /][contact-field label = 'E-pos’ tik email = '’ vereis = '1' /][contact-field label = ’Opmerking’ tipe = ’textarea’ vereis = '1' /][/Kontak Vorm]